Mammoth Chinese chip project raises another $5bn

Changxin Xinqiao Storage Technology, a semiconductor company based in Hefei in Anhui province that will operate the 150 billion yuan factory, recently raised the latest funding, according to credit information by a domestic research firm Qichacha.

The China Integrated Circuit Industry Investment, a state-backed entity helping to develop the nation's chip sector, was the main investor in the new financing. Also known as the "Big Fund," it holds a 33% stake in Changxin Xinqiao.

Changxin Xinqiao will use the money to accelerate the construction of the factory, with Beijing pushing to develop a semiconductor supply chain that is immune to U.S. sanctions amid intensifying tensions with Washington.

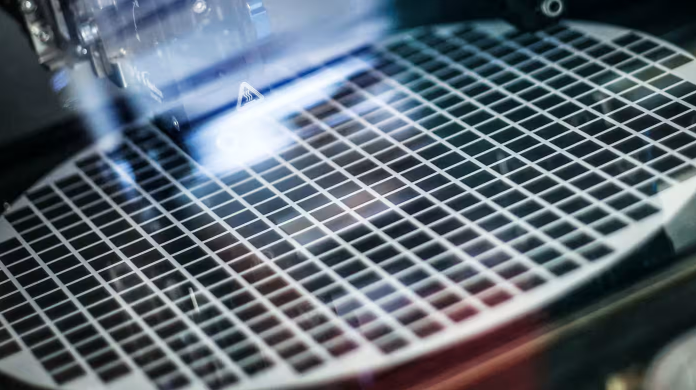

According to Chinese media, Changxin Xinqiao plans for the site to produce dynamic random-access memory (DRAM) chips, which are used in computers and a wide range of other electronics. The company has already started bidding for equipment for the new factory and will speed up those purchases and other procedures with the latest injection of capital. It aims to start mass production within three years, sources told Nikkei.

Hefei is also home to a production base for ChangXin Memory Technologies (CXMT), a major semiconductor company that churns out DRAM. CXMT has stakes in a company that holds the largest share of Changxin Xinqiao.

Changxin Xinqiao launched the DRAM factory construction project in Hefei in 2019 with the backing of the local government. It hammered out a policy of using Chinese-made semiconductor manufacturing equipment, and plans to procure related equipment from Naura Technology Group, China's largest state-owned chip machinery maker, and others.

As part of its efforts to develop China's semiconductor industry, the Big Fund in February invested an additional 13 billion yuan in Yangtze Memory Technologies (YMTC), which handles NAND flash memory used in smartphones and other devices.

Beijing around eight years ago announced its "Made in China 2025" policy to nurture high-tech industries, designating semiconductors a priority. The Big Fund was established during the discussions on that policy and has become the flag-bearer of semiconductor development in the country, investing about 140 billion yuan in a first phase of financing and about 200 billion yuan in its current second phase.

Using money from the Big Fund, the Chinese government has helped nurture three memory semiconductor companies: YMTC, CXMT and Fujian Jinhua Integrated Circuit in Fujian province.

However, U.S. sanctions have made it difficult to import new types of semiconductor manufacturing equipment, while the outflow of U.S. engineers is also casting a shadow over the sector.

From October last year, Washington has barred American companies from shipping certain grades of advanced chip equipment to any Chinese client without a license. It boosted those restrictions last month.

Beijing is considering a third phase of investment by the Big Fund after the second phase is completed, according to industry sources. Funding in the third phase could reach 300 billion yuan, beating previous levels.

Research firms at home and abroad estimate China's semiconductor self-sufficiency rate stands at 20% to 40%. Chips have become its largest import item, surpassing crude oil.